Bajaj Housing Finance Share: IPO listing, Share growth

Bajaj Housing Finance made its stock market debut today, September 16, 2024, listed on both the BSE and NSE. On its first day, the share delivered an astonishing profit of 114.28% to investors. This IPO has set several records, establishing itself as one of the best-performing IPOs of the year.

Many investors had eagerly anticipated this IPO, hoping for significant returns, and the initial figures have exceeded their expectations. What does the future hold for this stock following such a remarkable start? Let’s explore all the relevant information about Bajaj Housing Finance shares.

Bajaj Housing Finance Limited

Bajaj Housing Finance Limited (BHFL), a 100% owned subsidiary of Bajaj Finance Limited, provides home, business, corporate and many other types of finance. Today BHFL is providing its services to 88.11 million i.e. about 8.81 crore customers all over India. BHFL is RBI’s Upper-Layer Non-Banking Financial Company (NBFC).

NBFC companies are similar to banks but operate without a bank license.

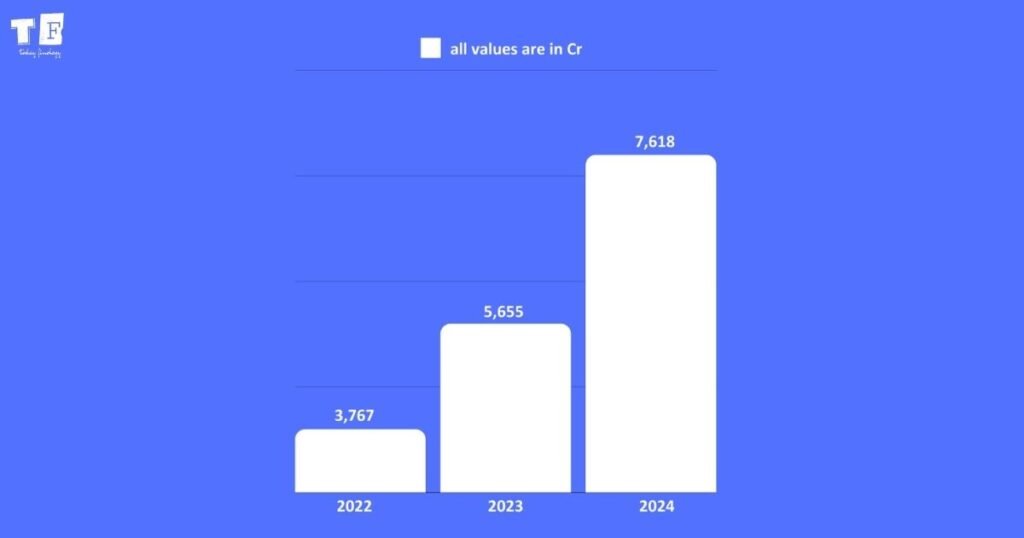

Talking about the performance of the company, the company has been continuously profitable for the last three years and has earned revenue of Rs 3767 crore, Rs 5655 crore and Rs 7618 crore in the years 2022, 2023 and 2024 respectively.

The IPO of Bajaj Housing Finance was open from September 9 to September 11, in which you could buy a lot of 214 shares. People invested heavily in this IPO and the reason for this is the credibility of the company and the trust of the people. Who does not know BAJAJ company in the whole world including India?

BAJAJ has a footprint in 3,800 towns, with 294 consumer branches and 497 rural locations. Also, company has 33,000 distribution points and more than 150,000 stores. Bajaj company is owned by the Bajaj family whose total net worth is $15B (according to a Forbes report of 2023).

Bajaj Housing Finance IPO Listing

Bajaj Housing’s IPO attracted considerable attention even before its listing. Once the IPO opened, investor confidence soared, resulting in a remarkable doubling of profits shortly after listing. In simple terms, an individual who purchased one lot (priced at Rs 14,980) saw their investment grow to approximately Rs 30,000 in just one day. This impressive performance is encouraging new investors to enter the market, which could have positive implications for overall market trends.

The IPO for Bajaj Housing Finance was available from September 9 to 11, with one lot consisting of 214 shares priced at Rs 14,980. It was officially listed on the NSE and BSE on September 16, 2024. Bajaj Housing Finance has emerged as one of the year’s top IPOs, delivering substantial returns to investors. Previously, IPOs from Tata Technology and Premier Energy had also created significant wealth for investors.

The company aimed to raise Rs 6,500 crore through the Bajaj Housing Finance IPO, with a price band set between Rs 65 and Rs 70. On the first day of trading, the shares were listed at Rs 150, exceeding expectations, and by market close, the price surged to Rs 164.99 on the BSE, reflecting a significant jump in value.

Is BHFL a good option for long-term investment?

The model of Bajaj Housing Finance Limited is strong and will also be beneficial for investors in future. However, if we look at the shareholding pattern, there is nothing much fun in it. BHFL with its strong customer base has been providing services to about 8.81 crore customers across the country for the last several years, which is a huge achievement in itself. Bajaj Housing Finance is a 100% owned subsidiary of Bajaj Finance.

As we all know Bajaj Finance has been continuously giving bumper profits to its investors. If we look at the revenue of BHFL in the last three years, it has been consistently profitable and this year it has earned a revenue of Rs 7,618 crore. The way the company’s shares opened on the very first day and the way people have expressed their trust in the company, it would not be wrong to say that this share is ready to make a high jump in the future.

BHFL Share Holding Pattern:

| Promoters: | 88.75% |

| Retail: | 6.50% |

| FII: | 2.34% |

| Mutual Funds: | 1.38% |

| Other Domestic Institutions: | 1.03% |

Who is the CEO of Bajaj Housing Finance Limited

Atul Jain is the Managing Director of Bajaj Housing Finance Limited, a position he has held since 2022. With over 16 years of service at the company, he has established himself as a visionary leader who has significantly contributed to the company’s success.

Before becoming Managing Director, Atul Jain served as the CEO for four years and has also held key roles such as Chief Collection Officer and Enterprise Risk Officer. His track record at Bajaj Housing Finance reflects outstanding performance, and there is every indication that this will continue in the future.

The leadership team at Bajaj Housing Finance Limited includes notable individuals such as Jasminder Singh Chahal, Pawan Bhansali, Amit Sinha, C.A. Vipin Arora, C.A. Niraj Adiani, Kumar Gaurav, and C.A. Dushyant Poddar, all of whom have played significant roles in the company’s growth.

| NAME | ROLL |

| Atul Jain | Managing Director |

| Jasminder Singh Chahal | President – Home Loan |

| Pawan Bhansali | Senior Executive Vice President – Near Prime and Affordable Business |

| Amit Sinha | Executive Vice President – Home Loans |

| C.A. Vipin Arora | Executive Vice President – CRE and LAP |

| C.A. Niraj Adiani | Executive Vice President – Risk |

| Kumar Gaurav | Executive Vice President – Debt Management Services |

| C.A. Dushyant Poddar | Executive Vice President – Developer Finance |

Top Housing Finance Companies in India

HDFC Ltd.

HDFC Limited has been one of the top companies in the housing sector for the last 45 years. HDFC Limited also provides many other finance facilities including home loans. As of April 2023, the total net worth of this company was ₹ 941,386 crores. HDFC has been successful in attracting its customers with attractive schemes. Started in 1977, this company has millions of customers and is providing its services in India as well as abroad.

LIC Housing Finance Ltd.

LIC Home Finance Limited, a subsidiary of LIC, serves lakhs of customers today. In addition to home loans, LIC HFL also offers property loans and fixed loans. The interest rate for LIC HFL loans is primarily set at 8.35% for a term of 20 years, with a processing fee of 0.50% based on the loan amount. LIC is one of India’s trusted and prominent companies, and it is committed to maintaining the trust that people have in it.

Indiabulls Housing Finance Ltd.

Indiabulls Housing Finance Ltd. (IHFL) is a non-banking financial company that provides many types of loans including home loans. IHFL has been ranked 20th in the Best Companies of India in the year 2019 and the company has also received the Best Social Media Brand Award in the BFSI sector in the year 2018. If we look at the home loan plans of IHFL, the company provides loans for 21 years at an annual rate of 8.8%, whose processing fee is 0.35% of the total loan.

PNB Housing Finance Ltd.

PNB Housing Finance Ltd., a company run by Punjab National Bank, was started in the year 1988. PNB Housing Finance Ltd. is one of the leading companies in the housing loan sector with a very large customer base. The company has served millions of customers so far and has a total of 189 branches by the year 2023. PNB HFL provides housing loans at 8.8% per annum for 30 years, the processing fee of which is meagre at 0.35% of the total loan compared to many other companies.

ICICI Home Finance Company Ltd.

ICICI Home Finance Company Ltd. is a leading company in the housing finance sector in India with a net worth of ₹ 139,285.6 million as of 2019. It was started in 1999 and is a subsidiary of ICICI Group. Apart from housing loans, ICICI Home Finance Company Ltd. also provides many other types of loans including property loans, FDs, commercial loans, gold loans etc. The company provides loans for a tenure of 30 years at an annual interest rate of 8.75%. The company is becoming a leading company in the market due to its customer support and attractive schemes.

Conclusion

Bajaj Housing Finance’s IPO was listed on the BSE and NSE today, September 16, 2024. Investors saw a profit of 114.28% on the very first day, making it one of the most successful IPOs of the year. BHFL, a wholly-owned subsidiary of Bajaj Finance Limited, offers a range of financial services. The company serves 88.1 million customers across India and has been recognized by the RBI as an Upper-Layer Non-Banking Financial Company (NBFC).

BHFL is projected to generate revenues of ₹3,767 crore, ₹5,655 crore, and ₹7,618 crore for the years 2022, 2023, and 2024, respectively. This IPO has sparked new interest in the market, particularly among new investors. With its strong business model and extensive customer base, BHFL could be a lucrative investment option.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investments in Share Market involve risks, including the potential loss of principal. Please consult a financial advisor before making any investment decisions.

FAQ

Is Bajaj Housing Finance part of Bajaj Finance?

a subsidiary company of Bajaj Finance Limited.

Who is the parent company of Bajaj Housing Finance?

Bajaj Finance Limited

Who is the MD of Bajaj Housing Finance?

Atul Jain

Is Bajaj Finserv RBI approved?

Yes

What is the future of Bajaj housing finance share?

The model of Bajaj Housing Finance Limited is strong and will also be beneficial for investors in future.

6 comments