Why Does Hindenburg Research Targets the Indian Finance And Business Sector?

A recent report caused a significant drop in the shares of India’s wealthiest conglomerate, the Adani Group. This report was released by Hindenburg Research, a U.S. based investment firm known for its focus on activist short-selling. Hindenburg generates its primary revenue through short-selling strategies and has exposed various scams involving some of the world’s top companies, particularly in India.

The report regarding the Adani Group marked Hindenburg’s first major spotlight in India. Following the release of this report, Adani shares experienced a dramatic decline, with some shares plummeting by up to 83%. The impact of Hindenburg’s findings has been profound, raising questions about why this research firm has chosen to target the Indian finance and business sector.

In today’s article, we will explore the motivations behind Hindenburg Research’s focus on India.

Hindenburg

Hindenburg is a U.S. based investment research company that focuses on Activist short-selling organizations. Hindenburg was founded by Nathan Anderson in New York in 2017 and it bears the name Hindenburg after the 1937 disaster that they see as a man-made, preventable disaster. Hindenburg company generates public reports published via its website that allege corporate fraud and misconduct.

Hindenburg Research does an investigative report published on a target firm by reviewing its public Record, exposing found transactions, corruption, and Internal corporate papers and speaking or reviewing with its Employees. A significant portion of the market capitalization of one of the biggest companies in India was lost as a result of the company’s study, “Adani Group: How The World’s 3rd Richest Man Is Pulling The Largest Con In Corporate History,” which made it renowned.

Who is behind Hindenburg’s research?

Nathan Anderson established the modest US-based investor-activist company Hindenburg Research in 2017. Hindenburg uses financial forensic techniques and a small team of researchers to identify possible accounting discrepancies and other concerns connected to corporate governance in largely well-known corporations.

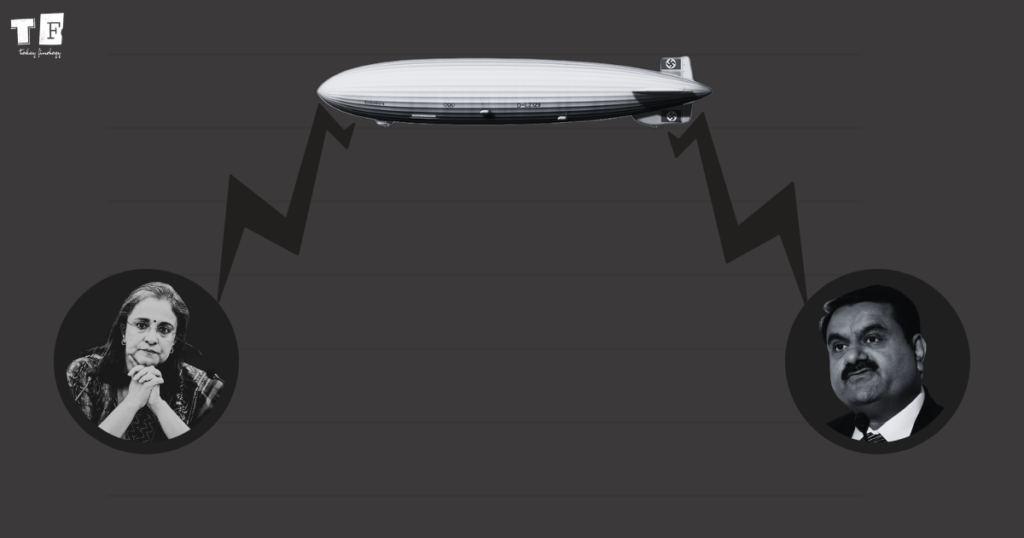

Hindenburg’s name has been linked to India’s famous industrialist Gautam Adani as well as SEBI chairperson Madhabi Puri Buch. Hindenburg’s report, apart from media reports, introduces us to those insider news of the market that we usually do not get to hear. According to Hindenburg, Madhabi Puri Buch and her husband have made a lot of investments in offshore companies associated with the Adani Group. This report by Nathan Anderson has also put Madhuri Puri Buch under question along with the Adani Group.

Is Hindenburg’s report true?

According to the Supreme Court Advocate, research on the SEBI Chairman is not reliable and is instead just conjecture. The crucial aspect of the entire debacle is that there isn’t a single solid piece of evidence in Hindenburg’s report that links Adani to the SEBI Chairman.

In some sources, Financial research company Hindenburg looks into and evaluates the financial statements of publicly listed firms. While some of their research and results have been contested, other research has been deemed to be valid and well-supported.

What is Hindenburg Research about India?

The Hindenburg Research investigation makes severe charges about the market regulator’s role as well as Madhabi Buch and her husband’s shareholdings. It claims that Buch invested in money associated with offshore firms related to Vinod Adani, Gautam Adani’s brother. Based on allegations against the Adani Group of firms, Nathan Anderson took a Hindenburg short-sell trade position that caused the firms’ market worth to be roughly $153 billion to be wiped overnight. From it, Hindenburg made little more than $4 million.

Impact of Hindenburg Report on Indian Market?

Hindenburg, located in the United States, said over the weekend that Buch and her husband invested in Adani Group-controlled offshore accounts. Buch, on the other hand, refuted the charges, claiming that all investments had been fully reported. The story had an impact on Adani stocks, which closed down up to 4%. In its examination of the Adani Group, Hindenburg Research has accused SEBI Chairperson Madhabi Puri Buch of having a conflict of interest. According to Hindenburg, Buch and her spouse have assets in Adani-related offshore funds. Buch and SEBI denied any misconduct, claiming that all required disclosures were made.

Read Also: Bangladesh Violence: Reason, Economic Challenges, Impact on Indian Economy

Which companies have Hindenburg targeted?

In January 2023, US-based short-seller Hindenburg Research released a study alleging that the Adani Group engaged in various questionable practices, including investing, stock manipulation, and undisclosed related party activities amounting to billions of dollars. The report also mentioned several prominent companies, such as IDFC, Yes Bank, and Kotak Bank, which Hindenburg targeted.

Hindenburg is focusing on top Indian companies experiencing rapid market fluctuations. As observed, Adani’s share prices were rising quickly, making it an easier target for Hindenburg, which then published its report on the company. Additionally, other notable companies were mentioned alongside the Adani Group.

- IDFC First Bank Share Price

- IndusInd Bank Share Price.

- YES Bank Share Price.

- Kotak Mahindra Bank Share Price.Axis Bank Share Price.

How much did Adani lose after Hindenburg Research?

The market value of the ten Adani stocks decreased to ₹16.7 lakh crore due to a 7% decline in shares of Adani Group firms, resulting in investors losing around ₹53,000 crore. This follows accusations made against the head of Sebi by US short-seller Hindenburg in a report.

It stated that Madhabi Puri Buch and her husband Dhaval Buch owned shares in offshore funds based in Mauritius and Bermuda that were utilised by Vinod Adani, the brother of Gautam Adani, “to amass and trade large positions in shares of the Adani Group.”

Madhabi Puri Buch and Adani-Hindenburg Controversy

The leading regulatory agencies in India will be examined by the Public Accounts Committee (PAC) of Parliament, which is scheduled to call witnesses on October 24 from the Securities and Exchange Board of India (SEBI) and the Telecom Regulatory Authority of India (TRAI). Representatives from the Ministry of Communications and the Department of Economic Affairs of the Ministry of Finance will also be present at the meeting.

TRAI Chairperson Anil Kumar Lahoti and SEBI Chairperson Madhabi Puri Buch are anticipated to be represented by senior officials, according to committee members, notwithstanding an unofficial legislative norm that institutional chiefs should attend such briefings in person. The relevance of this conference increases in light of the current issue regarding SEBI Chief Buch.

The ruling party is opposing the public accounts committee of parliament calling on Sebi Chairperson Madhabi Puri Buch to answer questions regarding the regulator’s investigation into the claim against the Adani Group, claiming it is using the legislative panel to malign the central government. This suggests that a full-scale confrontation between the BJP and Congress is imminent.

GQG partners & Adani-Hindenburg Controversy

Rajiv Jain formed GQG Partners LLC, an investment business, and the US Securities and Exchange Commission (SEC) has initiated action against it for impeding whistleblower rights. The SEC discovered that GQG prevented people from disclosing possible breaches of securities laws to the SEC through the use of non-disclosure agreements (NDAs) with 12 job hopefuls and a settlement agreement with a former employee.

The SEC’s ruling mandates that GQG pay a US$500,000 civil penalty, stop and desist from any breaches, and put in place procedures to guarantee adherence to whistleblower protections.

The Securities and Exchange Commission found that GQG had intentionally broken Exchange Act Rule 21F-17(a). This indicates that, while not being aware of the particular rule infringement, GQG knew what they were doing. The limiting clauses’ sheer inclusion in the agreements was enough to establish a breach, even though there is no proof that GQG ever enforced them.

Adani Group Rejects Hindenburg Allegations on Swiss Money Freeze

As part of an inquiry into money laundering and securities fraud allegations involving the conglomerate, the Adani Group has refuted charges made by Hindenburg Research, which claimed that Swiss authorities had frozen approximately $310.50 million across six Swiss bank accounts. Hindenburg substantiated its claim using a newly released record of the federal criminal court in Switzerland.

The Adani Group is resolute in its commitment to openness and observance of all applicable laws and regulations. We implore you not to publish this article and vehemently oppose this endeavour. It said, “We ask that you incorporate our statement in its entirety should you choose to move further.

Companies exposed by Hindenburg over the past six years

| 1. RD Legal (2016) |

| 2. Pershing Gold (Novenber 2016) |

| 3. Opko Health(Novenber 2016) |

| 4. Polarity TE ( December 2017) |

| 5. Riot Blockchain (December 2017) |

| 6. Aphria (December 2018) |

| 7. Liberty Health Sciences (December 2018) |

| 8. Yangtze River Port & Logistics (December 2018) |

| 9. Bloom Energy (septenber 2019) |

| 10. Smile Direct Club(October 2019) |

| 11. HF Foods (March 2020) |

| 12. Predictive Technology Group (March 2020) |

| 13. SC Worx (April 2020) |

| 14. China Metal Resources Utilization (May 2020) |

| 15. Genius Brand (June 2020) |

| 16. WINS Finance( June 2020) |

| 17. Nikola (Septenber 2020) |

Conclusion

Hindenburg Research has become a prominent force in corporate scrutiny, particularly within the Indian finance and business sector. By uncovering alleged fraud and misconduct through comprehensive investigations, the firm has not only affected stock prices but also ignited discussions about regulatory oversight and corporate governance. The case involving the Adani Group exemplifies the potential consequences of such reports, which can lead to significant financial losses and increased scrutiny of key figures, such as SEBI Chairperson Madhabi Puri Buch.

As Hindenburg continues to challenge powerful corporations, its influence on market dynamics and investor perceptions is likely to endure, prompting a closer examination of corporate practices in India and beyond. The impact of Hindenburg’s report was reflected in the Indian market, where stock prices experienced notable declines. However, the claims made by Hindenburg regarding the Adani Group have not been officially verified.

What are your thoughts on the Hindenburg-Adani dispute and its potential impact on the Indian economy? Please share your opinion in the comments.

1 comment